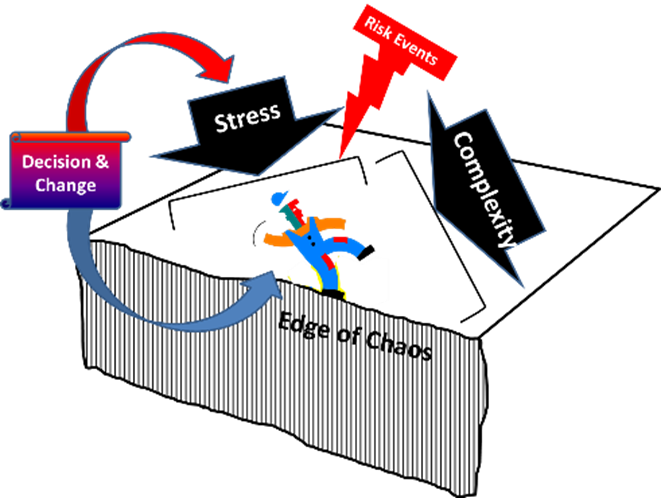

Complexity / Tipping point risk

The ValidRisk hybrid method, like most QRA methods, presumes that projects exhibit orderly, controlled, and in statistical terms, linear behavior in respect to risks. However, it is well known that highly complex projects are subject to the possibility of crossing a tipping point into disorderly, out of control, and in statistical terms, non-linear behavior; i.e., a blowout. A complex project that has a weak system and is stressed by multiple critical risk events is an economic time bomb. A paper on the topic by ValidRisk partner John Hollmann is available here.

The ValidRisk tool provides a “tipping point metric” to help warn if a potential blowout is encroaching. The tipping point metric uses selected systemic risk ratings, and the overall project-specific risk impact, to develop a score. The systemic risks shown by research to correlate with non-linear outcomes are size, decision making, team development, physical and execution complexity, and aggressiveness (bias). If these are “red”, action should be taken to mitigate these elements.

In addition, the ValidRisk tool has the option to apply the tipping point metric in the EV Monte Carlo simulation in a way that can generate non-linear outcomes. The greater the tipping point score, the more iterations of the MCS will blowout (in the worst case, 1 in 5 iterations). The scale of the blowout is largely driven by the project’s labor and labor-related costs (history shows these costs increase by 50 to 100% or more in a blowout). This optional view is not intended for “contingency”, but to flag the potential cost impact and accentuate the warning. In some cases, it may warrant establishing a management reserve; however, the working assumption is that the tipping point risk will be mitigated.